I got sick of spending an hour every night trying to think of what to make for dinner so I started making a menu for the family. I also find that keeping a menu keeps me on budget. I know that my Daughter has gymnastics on Tuesday and Wednesday so I make sure to have easy prep dinners on those nights. Sunday I make a lot of my puree and meals to freeze. I know I will be spending most of Sunday in the kitchen so I plan on a meal that goes well with what I am making that day.

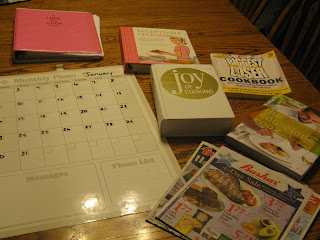

To prepare my menu for the month I get my food ad's out and my favorite cook books. Right now I like the conscious cook by Tal Ronnen, the biggest loser cookbook, deceptively delicious, the joy of cooking and of course my own cook book that I put together over the year with my favorite meals.

This process takes about an hour but it makes the entire month easier and NOBODY has to ask "Mom, what's for dinner?"

Wednesday, December 29, 2010

Getting ready for 2011

We had so many changes in 2010 that I have fallen behind on so many things. I know it will surprise all who know me but I have not clipped a coupon, planned my menu and have even fallen behind on a few bills in the past 3 months. Part of my job is to help my Husband with the bread route and it has us working long hours. Now that the holidays are coming to an end and our schedule is changing I am excited to focus on what I do best, MANAGE MY HOME.

I will be spending the next few days organizing my December files, sending out our tax statements, making our menu and organizing my coupons. Out with the old and in with the new. Old medicines need to be thrown away, old clothes donated and make room to stockpile.

I will be spending the next few days organizing my December files, sending out our tax statements, making our menu and organizing my coupons. Out with the old and in with the new. Old medicines need to be thrown away, old clothes donated and make room to stockpile.

Who is raising the kids?

We are so blessed to be the parents of two amazing kids. We went through some amazing obstacles for them to get to us but they are here and we are now responsible for their future. Everything we do and say are being view under a magnified glass and I want to make sure they understand our values. I drop my little babies off at daycare and cry all the way to work. I wanted these kids SO BAD and I am not even the one raising them half the time. I have to figure out a way to be home with them. I am paying $840/month in daycare and still have over $900/month in vehicle payment. We needed to figure out a way to get the vehicles paid off so that I can stay home with my kids, it did not happen over night but by the time they were 3, I was a stay at home Mom and we were DEBT FREE.

Other than taking care of my kids, my every day job became making Bobby's checks stretch as far as possible. I developed a system of saving and made it so that even on one income we had a good amount in savings to fall back on, started saving for retirement. Our entire family had health insurance and we were eating good home cooked meals. My Husband was so proud of my savings he would share it with everyone how I come home from CVS with 4 bags of drug store supplies and my total spent was $2.22 he would post the receipt on the fridge and I was excited he was so proud of me. Saving money has become my passion and I am showing my kids how to save. I hope my blog will help others who want to do the same.

Other than taking care of my kids, my every day job became making Bobby's checks stretch as far as possible. I developed a system of saving and made it so that even on one income we had a good amount in savings to fall back on, started saving for retirement. Our entire family had health insurance and we were eating good home cooked meals. My Husband was so proud of my savings he would share it with everyone how I come home from CVS with 4 bags of drug store supplies and my total spent was $2.22 he would post the receipt on the fridge and I was excited he was so proud of me. Saving money has become my passion and I am showing my kids how to save. I hope my blog will help others who want to do the same.

It all started with the tuna

I started my adult life in 1997. I graduated high school and was taking some collage classes, saved some money and moved into my first apartment in the big city of Phx to live closer to my boyfriend. He had come over to help set up my electronics and we had just come back from doing some shopping when I noticed my first msg on my answering machine. He pushed play and I heard my Dad telling me about a great tuna sale at Fry's. This was it, a glimpse at my future because I come from a frugal family and this is just the advice a fellow penny pincher would call about. My boyfriends reaction was "hey, that is a good deal" I sighed in relief because he could have said "what a weird thing to call about."

We have now been married for 12 years and he is just as excited as I am when I tell him about how much I saved at the store. Everything my parents taught me about being frugal really got us through some tough times in our life. We moved back to our hometown with only $5 in our pocket and no jobs. We sold our belongings and got by until we both found jobs. We made affordable meals and brought them to work with us. We had NO extra spending money but we were happy as can be.

After the first couple of years of our marriage I started spending more and not worrying about every penny like I used to. Bobby had a great job as a beer distributor and I had my dream job as a medical assistant in a surgical office. We were making great money and we found ourselves buying whatever we wanted at the grocery store, our home had big screen TVs, game systems, new furniture and we both had brand new vehicles. We took trips to Mexico, Catalina Island and went to Vegas a couple of times a year. This is great but I still wanted to start a family at some point and we had a great amount of debt.

We started changing the way we lived and started planning for our future. We managed to get our credit cards paid off just in time for our family to grow (by two).

We have now been married for 12 years and he is just as excited as I am when I tell him about how much I saved at the store. Everything my parents taught me about being frugal really got us through some tough times in our life. We moved back to our hometown with only $5 in our pocket and no jobs. We sold our belongings and got by until we both found jobs. We made affordable meals and brought them to work with us. We had NO extra spending money but we were happy as can be.

After the first couple of years of our marriage I started spending more and not worrying about every penny like I used to. Bobby had a great job as a beer distributor and I had my dream job as a medical assistant in a surgical office. We were making great money and we found ourselves buying whatever we wanted at the grocery store, our home had big screen TVs, game systems, new furniture and we both had brand new vehicles. We took trips to Mexico, Catalina Island and went to Vegas a couple of times a year. This is great but I still wanted to start a family at some point and we had a great amount of debt.

We started changing the way we lived and started planning for our future. We managed to get our credit cards paid off just in time for our family to grow (by two).

Subscribe to:

Posts (Atom)